All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash worth of an IUL are commonly tax-free up to the amount of costs paid. Any type of withdrawals over this amount may go through tax obligations depending on policy structure. Traditional 401(k) contributions are made with pre-tax bucks, minimizing taxable earnings in the year of the payment. Roth 401(k) contributions (a plan function available in many 401(k) plans) are made with after-tax payments and after that can be accessed (earnings and all) tax-free in retirement.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for a minimum of 5 years and the individual is over 59. Assets taken out from a standard or Roth 401(k) before age 59 might incur a 10% penalty. Not exactly The cases that IULs can be your own bank are an oversimplification and can be misinforming for several factors.

You might be subject to upgrading connected health and wellness questions that can influence your continuous costs. With a 401(k), the cash is constantly yours, consisting of vested employer matching no matter whether you stop contributing. Threat and Guarantees: First and primary, IUL plans, and the cash value, are not FDIC insured like common savings account.

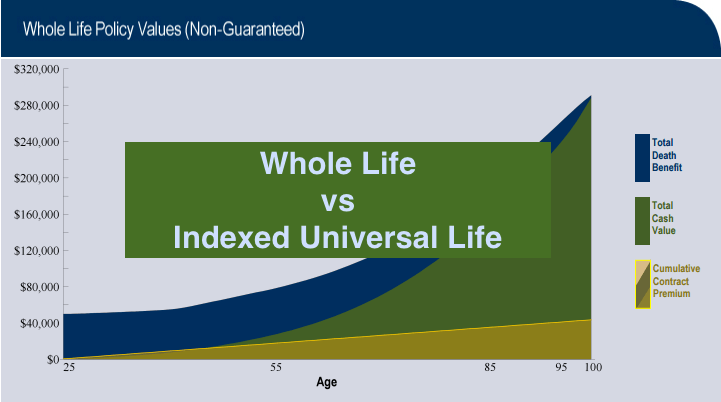

While there is normally a floor to avoid losses, the development capacity is topped (suggesting you might not totally gain from market increases). The majority of specialists will concur that these are not comparable items. If you want survivor benefit for your survivor and are worried your retired life savings will not be sufficient, then you may wish to think about an IUL or various other life insurance coverage product.

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

Certain, the IUL can provide accessibility to a money account, yet again this is not the key purpose of the item. Whether you want or require an IUL is a very specific question and relies on your primary financial objective and objectives. Nonetheless, below we will certainly try to cover advantages and limitations for an IUL and a 401(k), so you can better mark these products and make a more educated decision pertaining to the ideal means to handle retirement and caring for your enjoyed ones after death.

Index Universal Life Insurance Wiki

Funding Expenses: Car loans versus the policy accumulate interest and, otherwise paid off, reduce the fatality advantage that is paid to the beneficiary. Market Engagement Limitations: For the majority of policies, investment development is tied to a stock market index, however gains are usually topped, limiting upside possible - invest in iul. Sales Practices: These policies are typically sold by insurance agents who may highlight benefits without completely clarifying costs and threats

While some social networks pundits suggest an IUL is an alternative item for a 401(k), it is not. These are different items with various purposes, attributes, and expenses. Indexed Universal Life (IUL) is a sort of irreversible life insurance policy plan that additionally supplies a money worth part. The cash value can be made use of for multiple purposes including retired life cost savings, additional earnings, and other economic needs.

Latest Posts

Financial Foundation Index Universal Life

Is Global Index Universal Life Good

Best Iul For Cash Accumulation